By Bob Moser

CORRESPONDENT

Published: July 10, 2014 2:03 pm ET

Updated: July 10, 2014 2:12 pm ET

BUENOS AIRES, ARGENTINA — With per capita consumption steady and new machinery imports up last year from 2012, Argentina’s plastics sector looked like it would turn a corner in 2014 after consecutive years of industrial decline.

But with the economy expected to dip into a recession this year due to foreign currency shortages, inflation pegged at more than 30 percent since January, and risk of economic default for a second time since 2001, players big and small within the industry told Plastics News during Argenplás — held June 16-19 in Buenos Aires — that they’re entering uncharted waters.

“Argentina’s economy is a daily exercise in weaving the path for business, there are always surprises,” said Graciela C. Garcia, president of Julio Garcia e Hijos SA, the largest domestic producer of color concentrate and compound masterbatches. “We import as much as 70 percent of our raw material, so the peso’s inflation this year is a real challenge. But we try to look ahead to Argentina’s growth potential.”

That potential lies in steady growth of annual per capita consumption for plastics, which approached 44 kilograms for Argentineans in 2013, compared to 100 kilograms per person in NAFTA countries and Western Europe.

However, Argentina’s GDP is expected to drop 0.6 percent in 2014, according to a recent report from FocusEconomics. Multiple factors point to an economic recession through the rest of this year.

Economy recedes

The country’s trade surplus fell 41 percent on the year for January through May to $2.31 billion, due in large part to a plunge in automotive exports. Argentina’s currency has devalued by an estimated 30 percent since January, and reduced export demand from Brazil has pushed the country’s auto industry, responsible for 6.5 percent of the nation’s GDP, into crisis mode in recent months.

Honda became the sixth local carmaker in early June to temporarily stop production this year. The sector posted a 36 percent drop in production in May, and was down 22 percent through the first five months of this year, its lowest level since 2010. Exports of vehicles fell 39 percent in May, compared to the same month a year ago.

Industries of all types in Argentina are struggling with similar economic roadblocks this year, but local processors say plastics will be among the worst hit because of the sector’s dependence on raw material and parts imports.

Rules unclear

For more than two years now, Argentina’s government has applied a 14 percent tariff to imports that compete with locally-made goods. The tariff is reportedly also being applied intermittently to foreign machines that have no local competition.

This alone doesn’t deter processors from buying foreign machinery. The main barrier since 2012 has been written authorizations from federal agencies and pre-approval requests that are required for all imports, which local sources say can take anywhere from four months to more than a year for processing, with no clear timeline provided.

“It is clear that firms that import inputs, intermediate goods and capital goods … have had to include among their variables strong intervention from the government,” said Sergio Hilbrecht, director of Argentina’s lead trade association for the plastics industry, CAIP. “This situation, to which the plastics industry is not immune, impairs production planning, causes delays in the marketing of products and delays investment.

“Looking ahead to inflation, expectations are not very encouraging indeed, but rather pessimistic,” he continued. “This scenario … severely affects increases in production, which has involved a loss of competitiveness, evidenced by the fall in our exports from 2010 to date.”

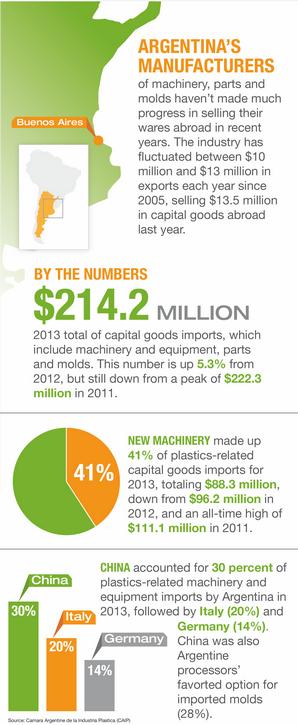

Plastics consumption in Argentina totaled 1.8 million metric tons last year, down 0.4 percent from 2012, according to data from CAIP.

Domestic production of plastics in 2013 featured a slight increase of 0.5 percent. Total imports of plastic products (finished and semi-finished) reached 185,819 tons, down 12.2 percent from year prior, while Argentina’s exports of plastic products totaled 126,943 tons, down 7.9 percent from 2012.

Dollars hard to get

Argentina’s government is also restricting foreign currency that companies can use to spend abroad, in order to ensure enough dollars are available for the country to pay its debt.

“I understand Argentina doesn’t have infinite dollars in its reserve, so the government must manage this,” said Leandro Fabro, owner of Fabro Hnos., a seller of domestic and imported injection and extrusion machinery. “It’s not good for my business, but I can see how if everyone buys from abroad, it will wreck the economy.”

The government has been unable to borrow money abroad since it defaulted in 2001 on $82 billion in sovereign bonds, making it dependant on incoming U.S. dollars from trade to pay creditors, and support the nation’s currency.

The country now faces the real risk of a second economic default, following a U.S. Supreme Court ruling in mid-June for Argentina pay $1.5 billion to American bondholders. The previous default led to national riots, inflation of 40 percent and more than 53 percent of citizens falling below the poverty line.

‘New level of unstable’

GTR, a growing producer of polypropylene spunbond nonwoven fabrics, should triple its production capacity with the addition of a second line by the end of this year. The company spent $2.5 million from savings to import a new machine from China, and expects to pay 18 percent or more in import tariffs to release the machine from customs in Buenos Aires, despite the fact that no local manufacturer offers a competing model.

It all should be worth the hassle, thanks to rapid growth in domestic demand and the company’s protection from imported nonwoven fabrics. But the uncertainty of what economic default could do to consumer confidence has company CEO Sergio Roitman on edge.

“Argentina has been unstable for a few years now with the import taxes and foreign product denials, but they were there to promote local industry,” he said. “This would be a new level of unstable.” |